DOP NPS Online Services | Post Office Online NPS Services | India Post NPS Online Services Subscriber Registration URL Links

Department of Posts(DOP) starts providing NPS Online Services. All eligible citizens may avail this facility hassle free, without physically visiting any post office

Department of Posts(DOP) is now pleased to start providing NPS (All Citizen Model) through online mode w.e.f. 26.04.2022.

Any Citizen of India in the age group of 18-70 years of age group can avail this online facility by visiting the official website of the Department of Posts (www.indiapost.gov.in) under the menu head "NPS"

The specific link is https://www.indiapost.gov.in/Financial/Pages/Content/NPS.aspx

Link for DOP NPS Online Subscriber Registration and Initial Contribution:

- Subscriber Registration & Initial Contribution

- Link for DOP NPS Online Subsequent Contribution:

- Subsequent Contribution

- Link for DOP NPS Online SIP Activation:

- SIP Activation

Facilities like new registration, initial/ subsequent contribution and SIP options under NPS Online are available to the customers at minimum charges for all services. NPS service charge of the Department is amongst the lowest. The subscriber are also eligible for tax deduction in NPS as per declaration made by Ministry of Finance time to time under sec. 80CCD 1(B).

This online facility may be availed by all eligible persons for NPS without physically visiting any post office and to enjoy the hassle free experience at minimum fee structure. NPS Online facility will go a long way in promoting National Pension Scheme (All Citizen Model) and will ensure a secured and dignified life of people in the country in their old age.

Steps for DOP Online NPS Services (Subscriber registration,Subsequent Contribution) is as follows:

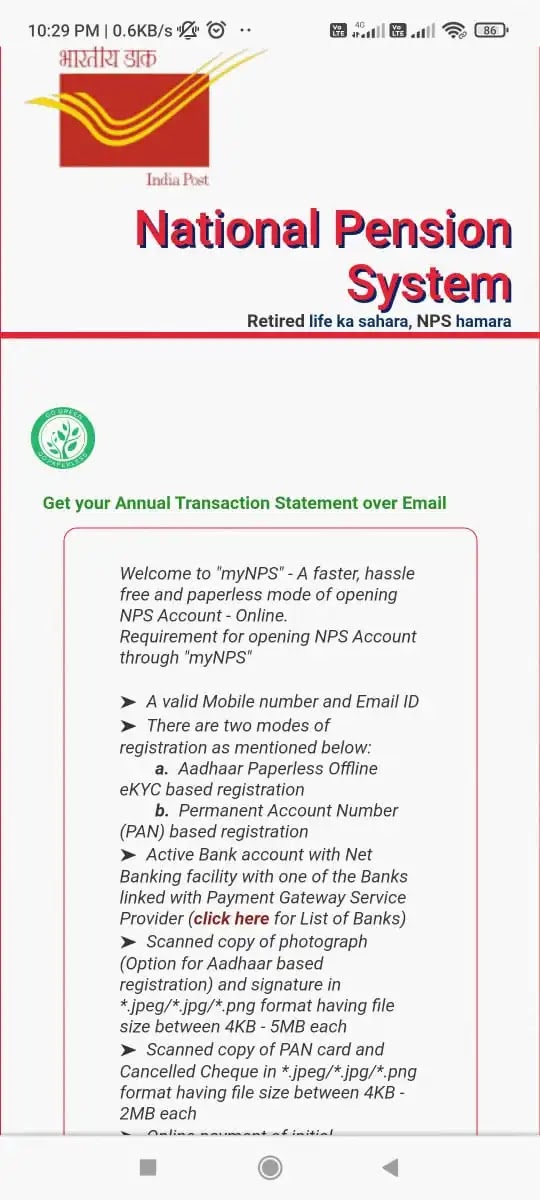

Requirement for opening NPS Account through "myNPS"

➤ A valid Mobile number and Email ID

➤ Active Bank account with Net Banking facility with one of the Banks linked with Payment Gateway Service Provider (click here for List of Banks)

➤ Scanned copy of photograph (Option for Aadhaar based registration) and signature in *.jpeg/*.jpg/*.png format having file size between 4KB - 5MB each

➤ Scanned copy of PAN card and Cancelled Cheque in *.jpeg/*.jpg/*.png format having file size between 4KB - 2MB each

➤ Online payment of initial contribution (Minimum amount ₹ 500) through Internet Banking

➤ Subscriber can complete registration through OTP Authentication or eSign the registration form

➤ In case you are unable to do OTP/eSign authentication, please print the form, paste your photograph (please do not sign across the photograph) & affix signature and send to NSDL. Please note the form should be attested by nodal office

➤ In case of Corporate Subscriber registration, Online payment of initial contribution is not required

✔ NPS account can be opened by All India Citizens between 18-65 years through "NSDL NPS" (Except NRIs)

✔ PRAN in NPS is portable across sectors and locations

✔ Government employees mandatorily covered under NPS, are requested to approach their Nodal Office for opening NPS account

✔ NPS Subscribers can claim tax deduction up to 10% of gross income under Sec 80 CCD (1) with in the overall ceiling of Rs. 1.5 lac under Sec 80 CCE

✔ An additional deduction for investment up to Rs. 50,000 in NPS (Tier I account) is available exclusively to NPS subscribers under subsection 80CCD (1)

For features and benefits of NPS please visit NSDL CRA website. www.npscra.nsdl.co.in

In case of Aadhaar Paperless Offline e-KYC based registration, the basic details like Name, DOB, Address and Photo would be pre-fetched from the UIDAI database. There will be no separate KYC verification process.

In case of PAN based registration, please ensure you have an existing active account (Bank Account/Mutual Fund/Demat Account/Insurance, etc) with the POP before initiating the registration. Also ensure that the details provided for your NPS account (address and Date of Birth) should match with the records available with the POP for which KYC will be carried out. The name provided under NPS should match with the name appearing on PAN.

No comments