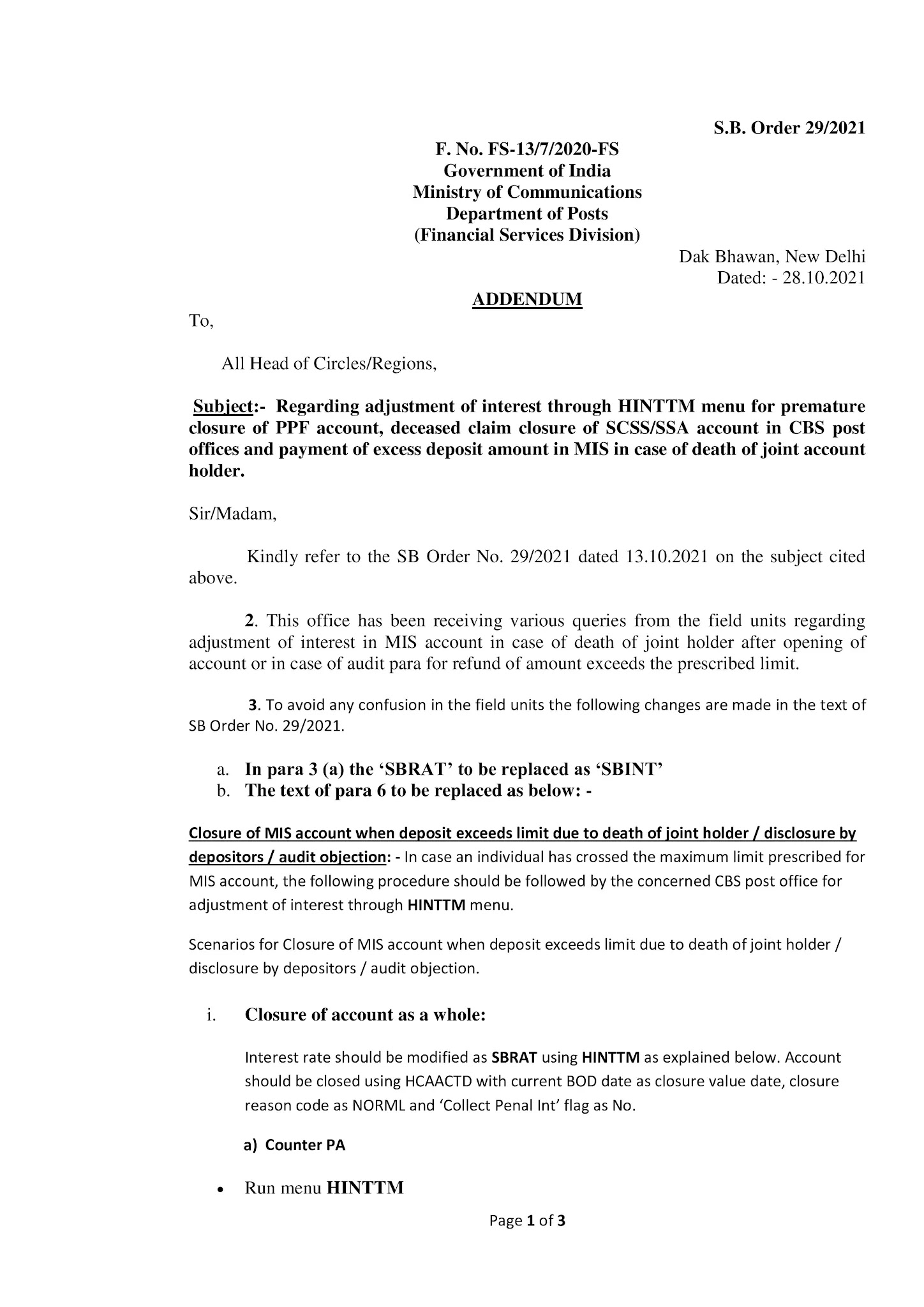

SB Order 29/2021 Addendum - adjustment of interest through HINTTM menu for premature closure of PPF account, deceased claim closure of SCSS/SSA account in CBS post offices and payment of excess deposit amount in MIS in case of death of joint account holder

ADDENDUM S.B. Order 29/2021 Regarding adjustment of interest through HINTTM menu for premature closure of PPF account, deceased claim closure of SCSS/SSA account in CBS post offices and payment of excess deposit amount in MIS in case of death of joint account holder

F. No. FS-13/7/2020-FS Government of India Ministry of Communications Department of Posts (Financial Services Division) Dak Bhawan, New Delhi Dated: - 28.10.2021

All Head of Circles/Regions,

Sir/Madam,

Kindly refer to the SB Order No. 29/2021 dated 13.10.2021 on the subject cited above.

2. This office has been receiving various queries from the field units regarding adjustment of interest in MIS account in case of death of joint holder after opening of account or in case of audit para for refund of amount exceeds the prescribed limit.

3. To avoid any confusion in the field units the following changes are made in the text of SB Order No. 29/2021.

a. In para 3 (a) the ‘SBRAT’ to be replaced as ‘SBINT’

b. The text of para 6 to be replaced as below: -

Closure of MIS account when deposit exceeds limit due to death of joint holder / disclosure by depositors / audit objection: - In case an individual has crossed the maximum limit prescribed for MIS account, the following procedure should be followed by the concerned CBS post office for adjustment of interest through HINTTM menu.

Scenarios for Closure of MIS account when deposit exceeds limit due to death of joint holder / disclosure by depositors / audit objection.

i. Closure of account as a whole:

Interest rate should be modified as SBRAT using HINTTM as explained below. Account should be closed using HCAACTD with current BOD date as closure value date, closure reason code as NORML and

‘Collect Penal Int’ flag as No.

a) Counter PA

• Run menu HINTTM

• Select Function = M — Modify

• Entity Type = A-Accounts

• Entity ID = MIS Account number

• Go

• Interest Table Code = SBRAT

• Start Date = Date upto which MIS interest is applicable + 1 (For example one of the joint depositors died on 03-04-2021, date to be entered as 04-04-2021)

• End Date = 31-12-2099

• Submit

b) Supervisor

• Run menu HINTTM

• Select Function = V — Verify

• Entity Type = A-Accounts

• Entity ID = MIS Account number

• Go

• Verify the account number and date of the applicable SB Interest rate.

• Submit

11. Closure of account partially, to the extent of excess deposit:

a. If part of the deposit amount becomes excess from the date of opening itself, Interest rate need not be modified in HINTTM. Closure should be done using HCAACTD as follows to ensure that SB

interest will be applied for the amount being withdrawn:

• In HCAACTD criteria screen excess deposit amount has to be entered instead of the entire principal amount

• Closure value date should be current BOD date

• Closure reason code should be entered as NORML in Closure Exceptions tab

• After this, Interest Code field gets enabled in Closure Details tab

• SBRAT should be entered in the Interest Code

• Submit

b. If part of the deposit becomes excess after the date of opening, three steps are to be followed meticulously:

(i) HINTTM — Modify interest rate to SBRAT as explained in option (i) above Close account in HCAACTD as follows:

ii. In HCAACTD criteria screen excess deposit amount has to be entered instead of the entire principal amount

• Closure value date should be current BOD date

• Closure reason code should be entered as NORML in Closure Exceptions tab

• Visit Closure Details tab and then Submit

• Verify account closure in HCAACVTD

(iii) HINTTM — Modify interest rate to MISGN with start date as account opening date to ensure that original rate of interest is applied to the balance amount in the account. Warning message during modification regarding start date can be accepted. Verify HINTTM changes from Supervisor ID.

NOTE: If current date or date of death is entered as start date while changing the interest rate back to MISGN, wrong interest rate will get applied for the monthly interest payable on the balance left in MIS account.

iii. If the MIS account has already matured and the date of death/excess deposit falls before maturity, then there is no provision to change the rate of interest in HINTTM. Interest to be recovered, if any, needs to be calculated by SOL/SBCO and HIARM entry with applicable date as BOD date should be done for Debit Interest & Credit run indicator. Amount entered as IAR will get recovered from principal amount during closure.

iv. In all the scenarios explained above, SOL user should check Trial Closure in HCAACTD prior to actual closure, to ensure that interest calculation happens as expected.

4. It is requested to circulate this clarification to all post offices for information, guidance and necessary action.

5. This is issued with the approval of the Competent Authority.

Yours Sincerely,

(Devendra Sharma) Assistant Director (SB-II)

Copy to: -

1. Sr. PPS to Secretary (Posts)

2. PS to Director General Postal Services.

3. PPS/ PS to Addl. DG (Co-ordination)/Member (Banking)/ Member (O)/ Member (P)/ Member (Planning &

HRD)/ Member (PLI)/ Member (Tech)/AS & FA

4. Add1. Director General, APS, New Delhi

5. Chief General Manager, BD Directorate / Parcel Directorate / PLI Directorate

6. Sr. Deputy Director General (Vigilance) & CVO) / Sr. Deputy Director General (PAF)

7. Director, RAKNPA / GM, CEPT / Directors of all PTCs.

8. Director General P & T (Audit), Civil Lines, New Delhi

9. Secretary, Postal Services Board/ All Deputy Directors General

10.All General Managers (Finance) / Directors Postal Accounts / DDAP.

11. Chief Engineer (Civil), Postal Directorate

12. All Sections of Postal Directorate

13. All recognized Federations / Unions/ Associations

14.GM, CEPT for uploading the order on the India Post website.

15.Dy. Director (CEPT) for information and configuration in Finacle accordingly. 16.MOF (DEA),

NS-II, North Block, New Delhi.

17. Joint Director & HOD, ICCW Building, 4 Deendayal Upadhyay Marg, New Delhi

18. ADG, OL Section, Dak Bhawan for Hindi Translation of this SB Order.

19. Guard File

Download SB Order 29/2021 Addendum in pdf

No comments